Content

Fintech Software Development: Essentials

Time to read: 20 minutes

Fintech is a locomotive that pulls the entire financial world, forcing it to change and introduce new technologies. High competition among fintech companies accelerates all processes, and new services appear at the speed of light. So, what conclusion should a fintech startup draw from this? First, when launching your project, you should pay careful attention to the software vendor.

To keep up with the industry, you will have to change a lot on your platform, add services, and make those services more accessible, flexible, and technologically advanced. A mistake in selecting the software for a fintech project can cost you dearly. But how can you make the right choice? Evaluate the software for your fintech startup according to various parameters and you will immediately understand. How can you avoid making a mistake, and what aspects of fintech software development should you take into account? We answer these questions in our article.

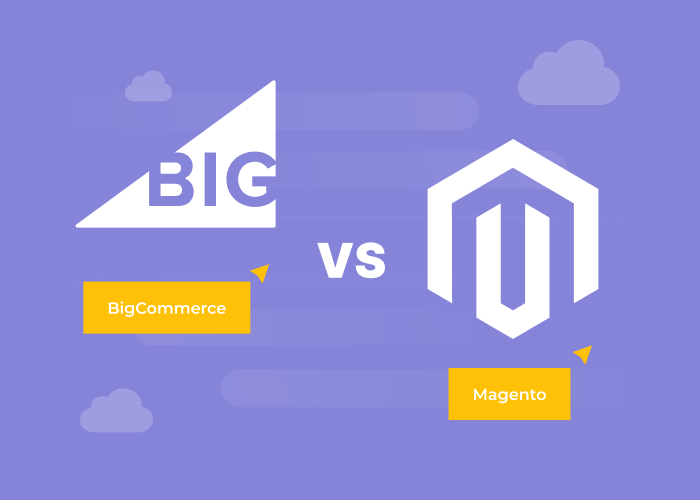

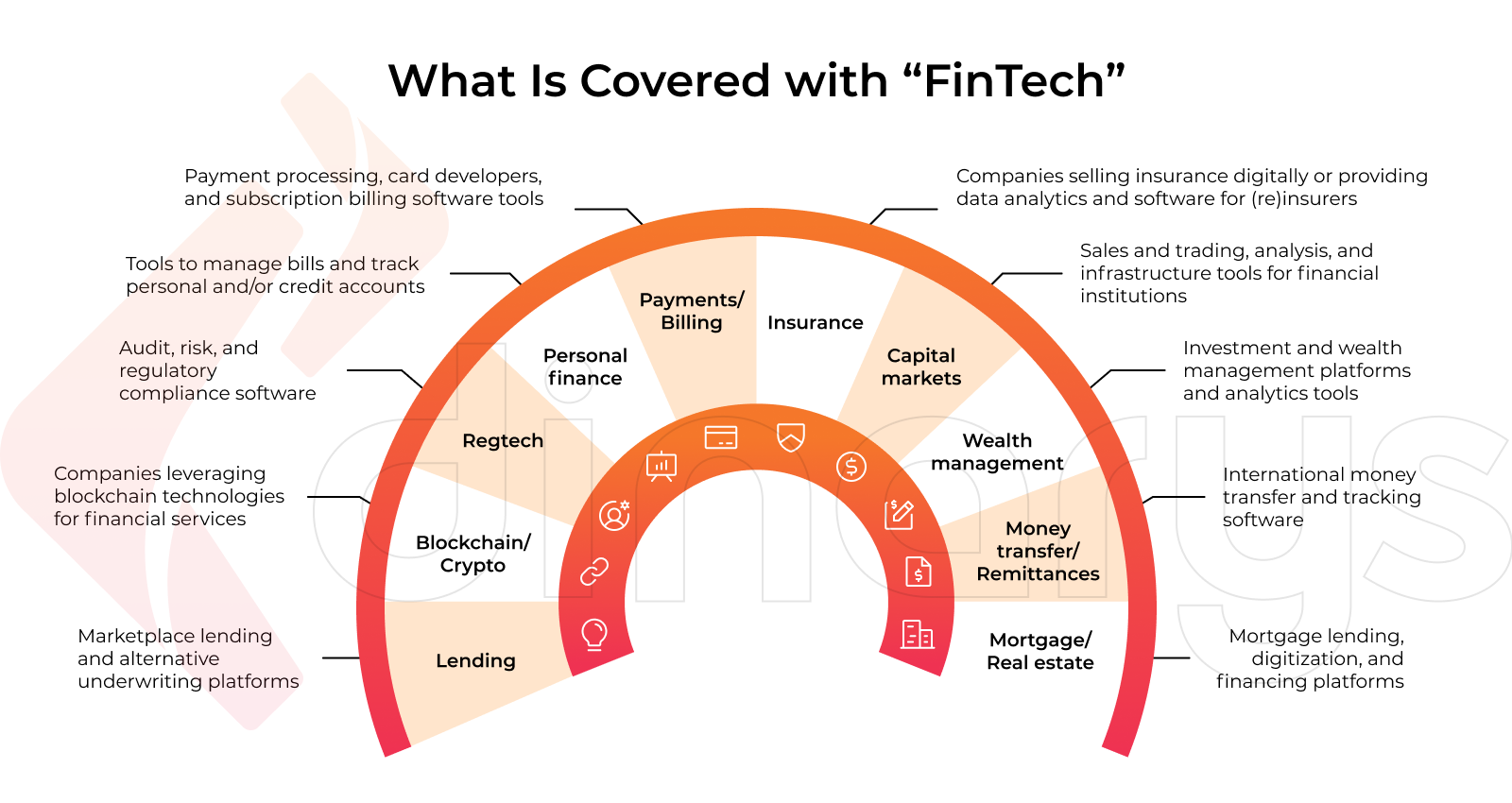

What Falls Under Fintech?

Fintech (financial technology) refers to technologies that help finance departments and companies manage the financial aspects of their business using emerging technologies. We are talking about big data, artificial intelligence (AI) and machine learning, blockchain, cloud technologies, biometrics, and others.

Simply put, these are software applications that make the relationship with money more accessible, faster, and more reliable.

Fintech is also an industry where companies use new solutions and technologies to compete with traditional financial institutions for clients.

Categorization: who qualifies as fintech?

Players in the financial services arena can be classified into different clusters. We present the prominent participants in financial transactions as follows:

- Traditional financial services firms. A financial services company is a company that manages, invests, exchanges, or holds money on behalf of customers. This can include a range of businesses, such as banks, credit card companies, insurance companies, accountancy companies, credit unions, stock brokerages, investment funds, and consumer finance companies.

- Technological companies. In addition to their primary activity, these companies provide financial services. Uber is a well-known example of such a company. It has branched out further into the financial services business with a new project, Uber Money. Uber Money is now in charge of everything related to financial products designed to support drivers. In short, Uber Money will control the credit card, debit card, Uber driver wallet, Uber Pay, Uber Cash, and other financial products that Uber may roll out in the future.

- Professional investors. The securities market is not homogeneous, so market participants have different statutes that allow them to conduct simpler or riskier transactions. For example, some participants are professional investors working with financial instruments that are unavailable to everyone. A qualified investor is someone with a financial or legal background capable of performing transactions in the securities market using financial instruments available only to participants with this special status.

Lets talk about itHave a project in mind?

Fintech Market Overview

The pandemic gave a considerable boost to digitalization. Many prominent players introduced online financial transactions, which caused the explosive growth of fintech e-commerce. The Matrix Fintech Index announced that investments in fintech in 2021 could reach $100 billion. There are good reasons for this: in 2020, the industry grew by 97%.

The current state of the fintech market

Financial services represent one of the most competitive and in-demand sectors. The pandemic has especially led to a sharp increase in online payments and exacerbated the issue of transaction costs. Consequently, businesses are updating requests for alternative modes of online payment, including electronic wallets, QR codes, and cryptocurrencies. Of course, international payment systems will not disappear, but solutions will be developed that will affect the changing role of Visa, MasterCard, and acquiring banks.

Regarding the state of the fintech market in 2020, the following features can be distinguished:

- Two out of three financial transactions are done online.

- AI and machine learning will replace 40% of existing banking roles.

- The fintech industry attracts investments totaling $50 billion every year.

- More than 500 fintech products are released every year.

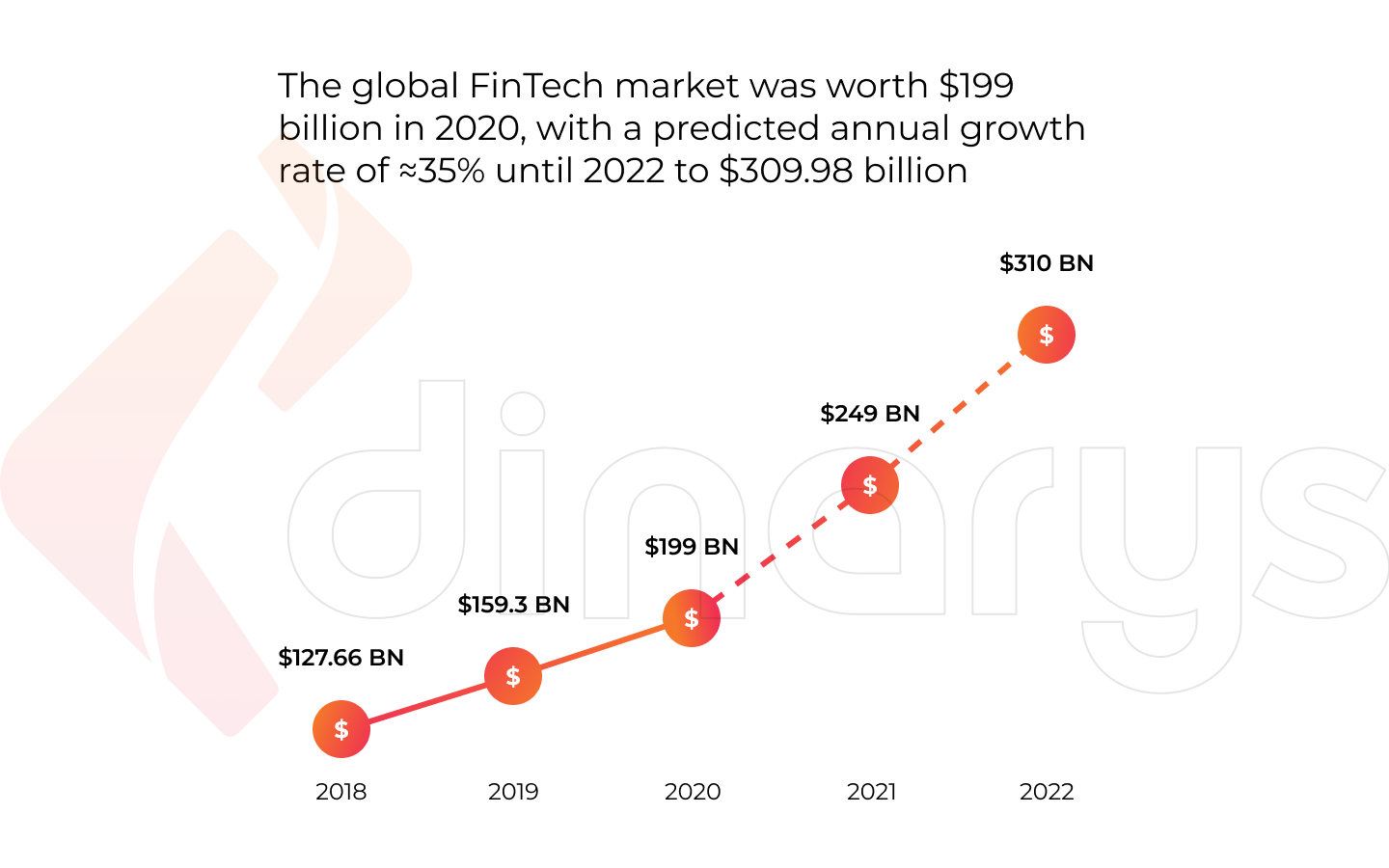

- The global fintech market as of 2020 is worth $199 billion, and by 2022, this figure is projected to increase by ~35% to $310 billion.

Fintech software development constraints

Detecting problems is much more important than generating ideas. Corporations do not conduct market research using a lean methodology. Then, if their new service is not in demand, they are surprised. Incubators, accelerators, and investment funds are inundated with non-viable presentations by startups. The founders cannot articulate the problem being solved, and yet they plan to invest in advertising. Below are some of the challenges to address in the fintech sector.

Consumer data security

Data security and privacy protection for organizations and consumers should always be the top priority in the fintech community. In addition, every fintech company, regardless of its size, has a serious responsibility to do whatever is necessary to protect the overall infrastructure of the financial services industry.

Adopting safeguards is critical because many business transactions occur within an interconnected global communications enterprise, increasing overall vulnerability.

Any fintech company that does not do everything in its power to protect itself and, in turn, its customers from the negative consequences of poor security practices is undeniably in gross breach of its responsibilities.

And to protect all your users' data, you need to comply with the GDPR and PCI regulations. Read on to learn how to be compliant with these regulations.

Legislation compliance

The financial sector is regulated by law. Even if fintech software is used, the government has the right to intervene. Executive authorities set standards and rules to protect users' personal information. Companies face threats from cybercriminals when security protocols are inappropriate, and this can result in financial penalties from regulators.

To protect yourself from government fines and sanctions, you need to verify your compliance with the law before creating software. So, before entering the market, make sure you or your legal department are aware of the latest government regulations.

Technologies Shaping the Fintech Software Market

There have been so many breakthroughs in the fintech industry—and there will be many more! But is there enough space for all innovators and traditional banks? What exactly does the latter have to fear?

Heather Cox, an accounting expert and digital marketer at Citi, said at IBM InterConnect 2015, "People need banking but not banks." New, more customer-friendly services are emerging that are changing the landscape before our eyes to satisfy increasingly demanding customers.

No bank would deny that the emergence of niche service providers makes life difficult for traditional banks, which have to do their best to retain customers. Banks can no longer trap clients in a complex of unnecessary services according to an incomprehensible scheme and then expect the clients' complete loyalty. One thing is clear: the ability to compete is inherent in fintech startups. Their indisputable advantages are their compactness, accuracy, technological know-how, and talented staff. So, what are the main trends that will shape the fintech market? Keep reading to find out!

Mobile banking applications

Bank branch services are a thing of the past. Thanks to mobile banking, all financial transactions go through users' smartphones in a matter of clicks. Just think about these numbers! There are roughly 169 million mobile banking users in the United States. This is about 65% of the US population. Furthermore, 80% of Americans believe they do not need to use a bank branch if they have access to mobile banking. Due to the growing popularity of mobile banking, user expectations and desires are changing. Consumers expect mobile banking to be convenient and secure and to provide additional features that foster financial well-being. Financial institutions that fall short of these expectations risk being left behind.

Due to the ongoing growth of the mobile banking market, these financial institutions can be controlled by numerous operating systems with different functionalities, which requires the technical implementation of the management tool to have several features.

ss.png)

The most widespread mobile banking options are as follows:

- Smartphone/tablet apps. These allow users to view their accounts and transactions through a financial institution's app and conduct transactions 24/7 from anywhere in the world.

- SMS banking. This is a remote banking service that gives customers access to their accounts and account transactions at any time using a mobile phone number previously registered with the bank. With the help of SMS, information is exchanged and commands are transmitted to perform banking operations.

- Control via USSD commands. USSD is a standard service in mobile networks that allows users to interact with the operator's service application via short messages. For example, with the help of commands and requests, banks can find out a card's balance, replenish a mobile account, block a lost card, etc.

Mobile banking has specific differences from Internet browser banking. The advanced features of mobile banking apps include the following:

- Finding the user’s exact location and searching for ATMs nearby.

- In-app authorization using biometric data (fingerprint, retina, face identification, etc.).

- Recognition of account details/payment documents from photographs.

- Reading QR codes from payments.

- Built-in antivirus.

- Instant notifications about the movement of funds and other operations (push notifications).

- Contactless payments (if there is an NFC module).

Blockchain

Blockchain is a continuous chain of blocks. It contains all transaction records. Unlike regular databases, you cannot change or delete these records; you can only add new ones. Blockchain is also called the technology of distributed ledgers because many independent users store an entire chain of transactions and a current list of owners on their computers. Even if one or more computers fail, the information will not be lost. Blockchain solutions represent one of the hottest developments in fintech. Initially, blockchain was created to ensure secure cryptocurrency transactions and protect against hacking attempts. This technology reduces risks for all market participants, so its implementation is essential for fintech.

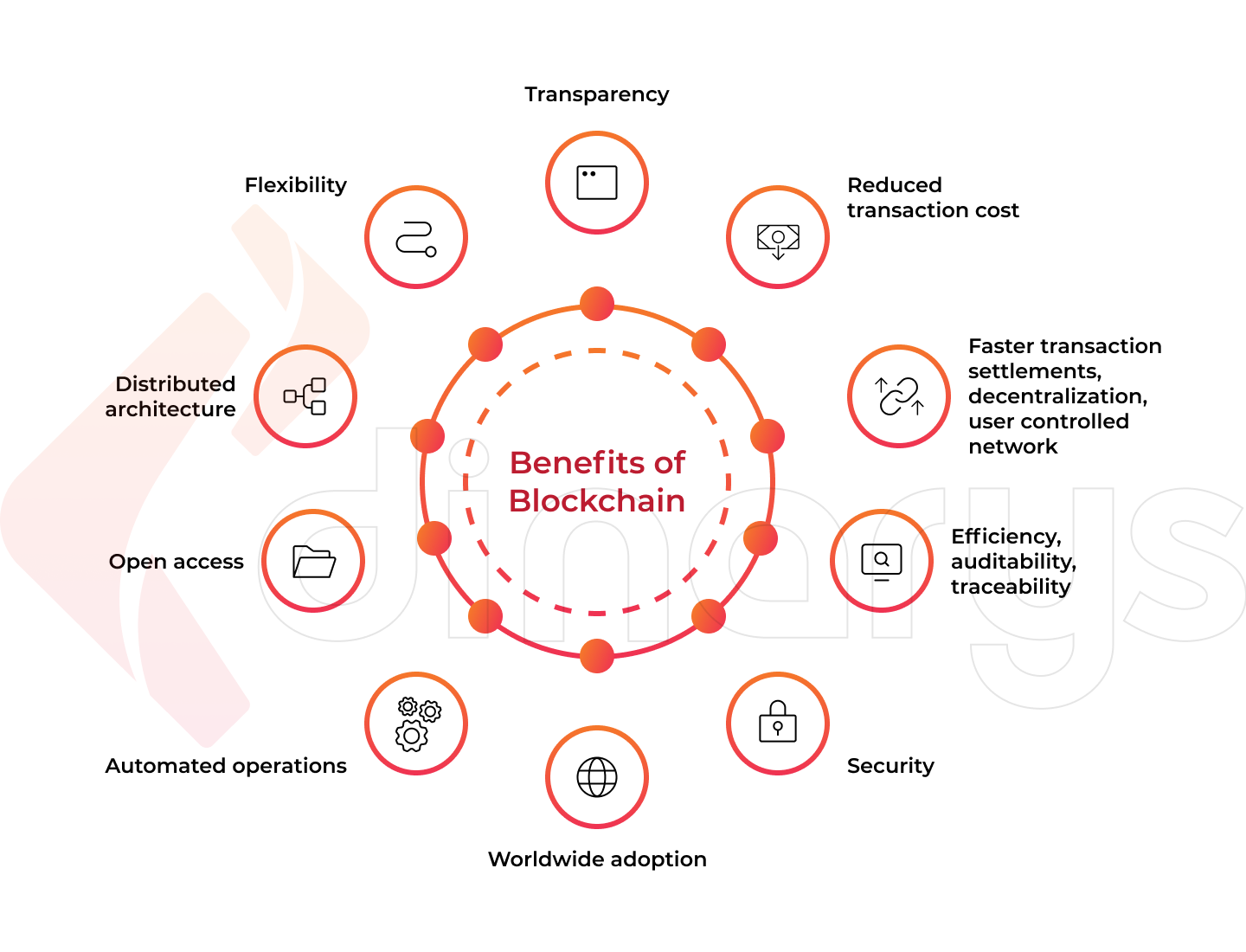

What are the benefits of blockchain for fintech?

- No single control center or storage location

- Faster execution of transactions without intermediaries

- Saving money by reducing the need for financial back-office staff

- Transparency between the parties involved in the transaction

- Safety of data due to multiple data duplication

- Measures for tracking and reporting in real-time

Here are some ways you can integrate blockchain into your fintech:

- Create utterly new custom fintech software to meet all your business requirements and to be highly adaptive, efficient, and optimized with the ability to make any changes if necessary.

- Customize existing software with additional blockchain-based functions. This will require less time than creating a custom solution, and employees will spend less time learning about new features.

- Use a ready-made financial service that is freely available. Such solutions are suitable for short-term purposes, but they may include a limited number of features.

Lets talk about itHave a project in mind?

Artificial intelligence and machine learning

The financial sector was among the first sectors to recognize the benefits of implementing AI technologies. The largest and most successful lending institutions have already developed formal AI strategies, and many have their own AI department. According to the forecast of research company Autonomous Next, by 2030, banks will be able to reduce costs by 22% using AI technologies. This could translate to a savings of $1 trillion for financial institutions. This approach has also proven helpful in staying ahead of the competition and delivering a personalized experience to customers.

AI helps fintech startups compete properly with existing market players or establish business-to-business (B2B) cooperation with them. And in business-to-consumer (B2C), some intermediaries make money on the formation of complex services from many small services provided by different companies. In addition to solving financial problems, AI can carry out any business process with a smooth operation (reduce data processing time, reduce repeated costs, automate internal procedures, and accurately compile work reports).

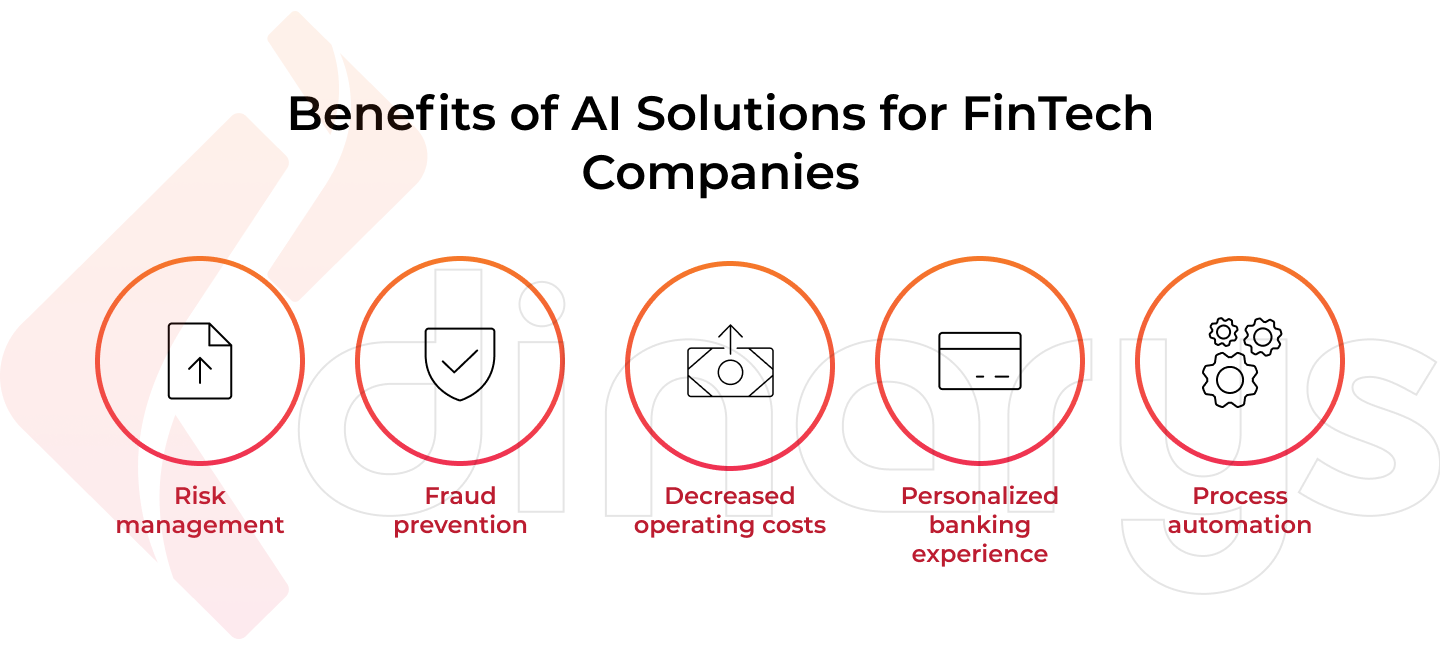

What are the benefits of AI for fintech?

- User engagement. Of course, the main advantage is high user engagement. AI solutions monitor app users, immediately answer their questions (chatbots), or collect analytics on user preferences and behaviors. AI solutions also help financial technology workers complete routine tasks, such as answering common questions, categorizing customers, and monitoring transactions and emerging regulatory requirements.

- User support. Another advantage is the reduced cost of user support. Fintech's AI and machine learning eliminate the risk of human error and save long-term user support costs. AI also supports secure payments. Fintech and AI work together to monitor expenses continuously and verify users, closing numerous security holes invisible to humans.

- Automated process. AI looks into every dark corner to help you collect documentation, generate reports, and make predictions. Thus, you get a powerful tool for building actionable business strategies—and, of course, attention to detail. AI keeps you on top of what's going on in your organization. What managers may overlook will never go unnoticed by technical tools; this rule applies to any data management task.

AI can solve several urgent problems in the financial industry. For users, this can mean improved service, and for financial institutions, an increase in the client base, cost reduction, and optimization of business processes.

RegTech (Regulatory technologies)

Government authorities and financial markets set their requirements for banking structures. Unfortunately, there are so many of these rules that companies do not keep up with them—and they spend huge sums on lawyers (at best) or fines (at worst).

It is impossible to follow every minute detail of the rules confidently. This is why RegTech is developing technologies that automatically track the correctness and legality of actions. RegTech's tasks include identifying clients, processing and protecting data, analyzing financial risks, and finding solutions to disputable situations. This helps you comply with legal regulations and avoid problems.

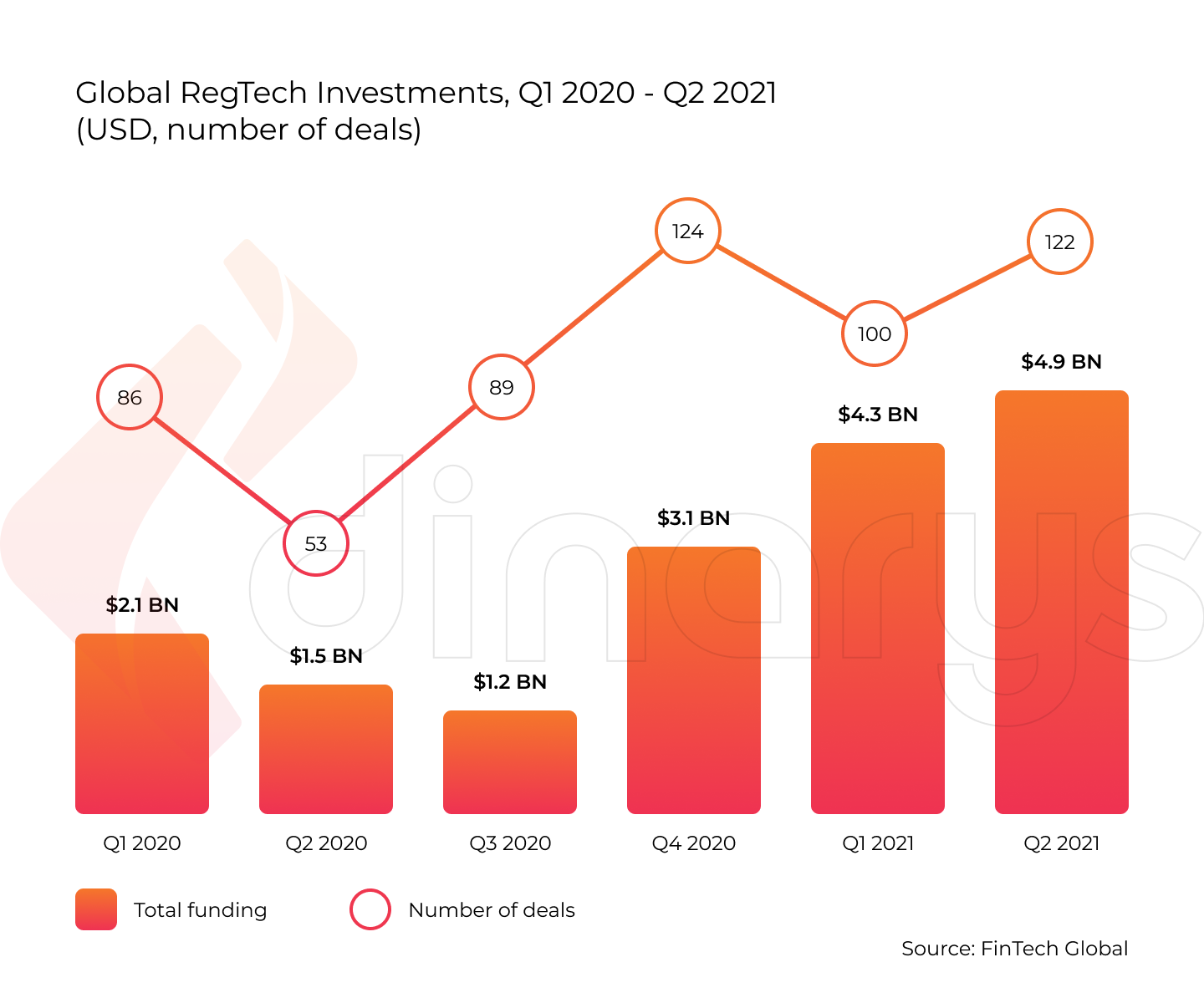

The last quarter of 2020 saw the highest growth in deals and total funds raised by RegTech companies worldwide. In the RegTech sector, sales increased by 39%, and the total volume of financing increased by $1.9 billion compared to Q3 2020. After a brief hiatus caused by COVID-19 in the first three quarters of 2020, investments in RegTech rebounded sharply in Q4 2020.

Certainly, these are far from all the trends in the fintech market, but this is an excellent base for implementation in your startup. If you want an individual selection of functionalities based on your business needs and goals, contact us to determine the best solution for your fintech software development.

Dinarys’ Fintech Case Study

Dinarys is highly skilled and extensively experienced in creating reliable, secure, and sophisticated fintech products. We are well aware of the trends and innovations in financial technology, are constantly learning and attending the best conferences in financial technology, and have a team of professional web and mobile developers specializing in Magento and Shopware platforms. Our experience shows that the technology stack you use will determine the capabilities and limitations of your product.

Below, allow us to present our best fintech project and show what practices, technologies, and approaches we used to improve the level of business in fintech.

Lets talk about itHave a project in mind?

ConnectPay

ConnectPay is one of the fastest-growing electronic money institutions in Lithuania and the leading fintech hub in continental Europe for providing banking services to internet-based companies. The client’s main business challenge was to develop ConnectPay modules for stores using Magento and Shopware e-commerce platforms and enable the stores to collect payments from customer bank accounts in the Netherlands, Germany, Finland, and Lithuania.

The client’s main business challenge was to develop ConnectPay modules for stores using Magento and Shopware e-commerce platforms and enable the stores to collect payments from customer bank accounts in the Netherlands, Germany, Finland, and Lithuania.

Dinarys' solution was to develop new modules. The main focus was on accelerating time-to-market and ensuring security, scalability, and cost-effectiveness.

Ready to Digitalize Your Financial Services?

The fintech industry is an area that requires the most incredible precision and safety in all operations. Digitalization helps to achieve this. In addition, companies use financial solutions software to improve employee productivity, customer satisfaction, and overall business performance.

Correctly selected fintech solutions will make life easier for all sides of interaction and automate most processes. Our Dinarys team is ready to offer you fintech web development and the implementation of any technologies you wish in your startup or existing project.

Given the variety of solutions, we insist on a unique selection of tools to ensure that your business derives the most benefits and avoids unnecessary expenses. So, leave a request. Our experts will analyze your current situation and help you choose an effective solution for scaling your business. We look forward to collaborating with you!

FAQ

Fintech (financial technology) refers to technologies that help finance departments and companies manage the financial aspects of their business using emerging technologies. It includes big data, artificial intelligence (AI) and machine learning, blockchain, cloud technologies, biometrics, and others. Simply put, these are software applications that make the relationship with money more accessible, faster, and more reliable. Fintech is also an industry where companies use new solutions and technologies to compete with traditional financial institutions for clients.

Blockchain is a continuous chain of blocks. It contains all transaction records. Unlike regular databases, you cannot change or delete these records; you can only add new ones. Blockchain is also called the technology of distributed ledgers because many independent users store an entire chain of transactions and a current list of owners on their computers. Even if one or more computers fail, the information will not be lost. Blockchain solutions represent one of the hottest developments in fintech due to the faster execution of transactions without intermediaries, saving money by reducing the need for financial back-office staff, transparency between the parties involved in the transaction, the safety of data due to multiple data duplication, and measures for tracking and reporting in real-time.

Dinarys is highly skilled and extensively experienced in creating reliable, secure, and sophisticated fintech products. We are well aware of the trends and innovations in financial technology, are constantly learning and attending the best conferences in financial technology, and have a team of professional web and mobile developers specializing in Magento and Shopware platforms. Our experience shows that the technology stack you use will determine the capabilities and limitations of your product.

Lassen Sie Profis Ihre Herausforderung meistern

Unsere zertifizierten Spezialisten finden die optimale Lösung für Ihr Unternehmen.